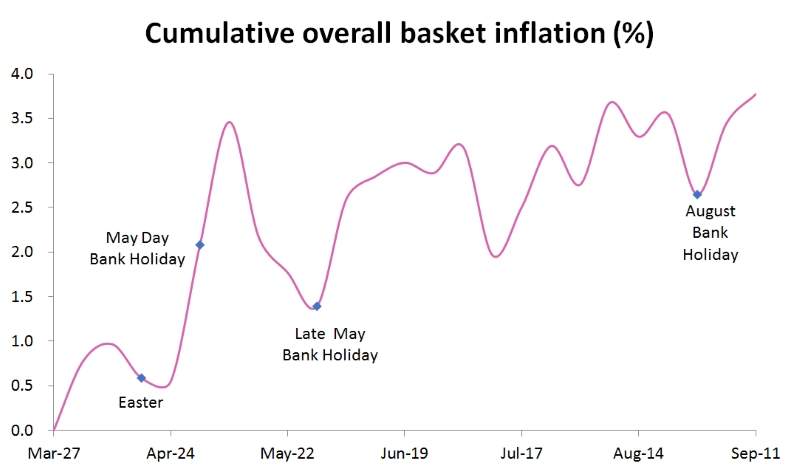

Food & grocery prices have risen by 3.8% at the big four UK grocers since the end of March 2017, according to GlobalData’s Food Price Index. Since the vote to leave the EU, UK grocers have been impacted by the devaluation of the pound, commodity price volatility and the renegotiation of supply contracts. The grocers have had little choice but to pass some of the resulting cost inflation on to consumers to maintain their operating margins – contributing to the improved sales figures with average like-for-like (LFL) growth of 2.7% in Q1 2017/18 among Tesco, Sainsbury’s and Morrisons (+1.3% including Asda’s -2.8% Q1 LFL).

After the initial volatility in shelf-edge prices post-Brexit, retailers have adapted to the change in the economic climate. They have moved to lock in supply contracts with more UK producers while embarking on cost-saving programmes to offset input inflation and reduce the proportion of cost increases being passed directly on to the consumer.

While Asda has been the cheapest of the big four for 18 of the 25 weeks covered in the graph above, prices increased by 4.5%. Asda was the second most inflationary after Sainsbury’s, which increased prices by 5.2% during the period (although prices have remained flat since 7 August 2017). Meanwhile, prices at market leader Tesco rose just 2.1% over the period, compared to 3.2% at Morrisons.

Despite Asda’s ongoing struggles, with negative LFLs for 11 out of the last 12 quarters, the value grocer has still passed much of the cost of input inflation on to the customer. Meanwhile, Morrisons CEO David Potts has said it is using the current period of inflation as a way to grow market share by avoiding raising prices as much as other grocers, particularly on key items.

Consumers can expect to see prices continuing to rise, albeit at a less volatile rate, but peaking at 3.3% in 2019. Tesco is likely to be best-placed to mitigate price rises as it can use its size to pressure suppliers into keeping prices down. Sainsbury’s has a more affluent customer base than its big four rivals, so will benefit from its customers being less price-sensitive, thus enjoying higher price elasticity compared to its competitors. Asda will be the most heavily affected as its less affluent customers are more price-sensitive and likely to be swayed to switch to the discounters.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataConsumers can expect to see prices rise across the big four grocers, placing further pressure on household budgets at a time when wage growth is lagging behind inflation, and impacting their ability to spend on other retail categories.