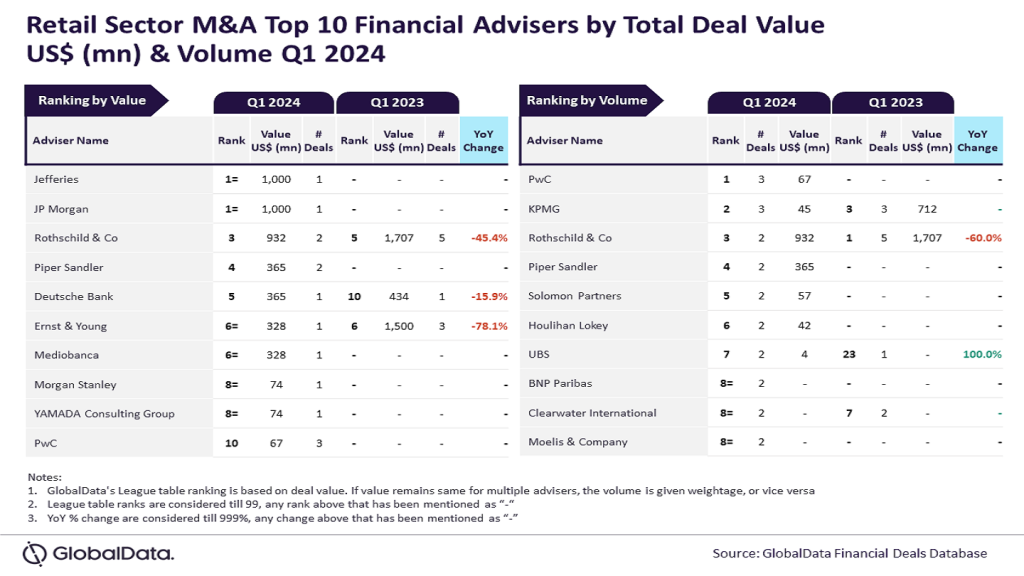

Jefferies, JP Morgan and PricewaterhouseCoopers (PwC) have emerged as the leading mergers and acquisitions (M&A) financial advisers in the retail sector by value and volume in the first quarter of fiscal 2024, according to GlobalData’s latest league table.

GlobalData, a leading data and analytics company that is the parent of Retail Insight Network, ranked advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, Jefferies and JP Morgan advised deals worth $1bn each, securing the top spot by value during the period.

PwC’s advisory work on three deals placed it at the top in terms of volume.

Rothschild & Co followed Jefferies and JP Morgan with $931.8m in advised deal value, with Piper Sandler and Deutsche Bank following at $365m with $365m each.

In terms of deal volume, KPMG came second with three deals, followed by Rothschild & Co, Piper Sandler and Solomon Partners with each advising two deals.

GlobalData lead analyst Aurojyoti Bose said: “Jefferies and JP Morgan, despite advising on only one deal, were the only advisers to hit the $1bn mark during Q1 2024. Meanwhile, PwC, which led by volume during the quarter, also occupied the tenth position by value.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.