Fashion retailer Next is reportedly in talks with administrators handling the insolvency of cosmetics chain The Body Shop, potentially seeking to acquire parts of the business.

According to Sky News, Next, known for its acquisitions of distressed retailers, expressed interest in assets that might be available for purchase, although the exact details and the likelihood of a deal remain uncertain.

The news agency added that doubts surrounded whether FRP Advisory, which was appointed to handle the insolvency, “would elect to run a conventional auction, with one source suggesting that contact between FRP and Next had already stalled.”

Both Next and FRP Advisory declined to comment.

A potential complication has emerged in attempts to acquire The Body Shop. The company's brand name and intellectual property (IP) are not included in the current administration process, Sky News reported.

This creates a hurdle for potential buyers, as these assets are crucial to the business' value and future operation.

It is important to note that Aurelius, the current owner that completed the acquisition of The Body Shop in January 2023, has secured these key assets alongside providing financial backing to the rest of the business.

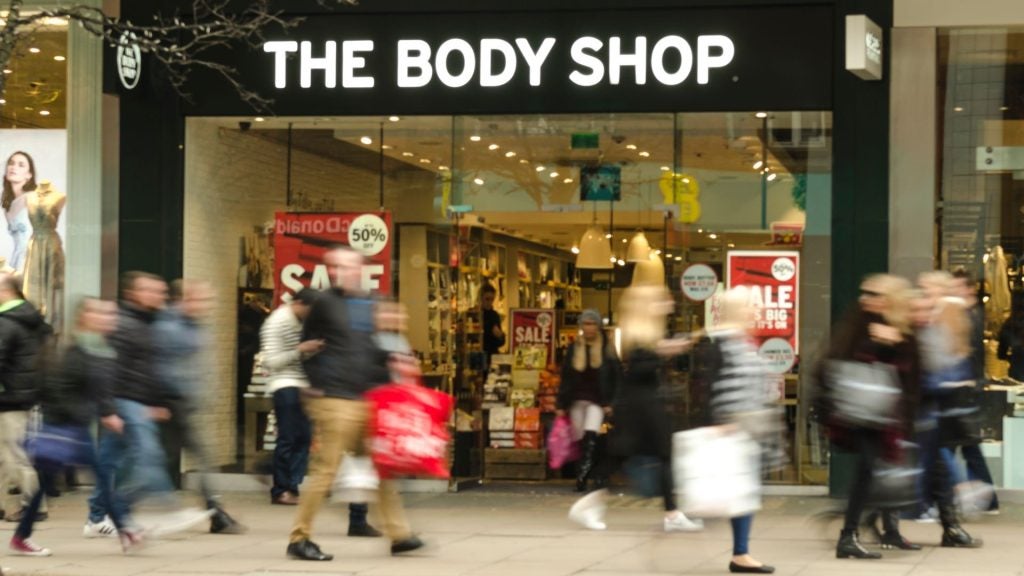

The Body Shop, facing financial difficulties, entered administration earlier this month. The administrators are considering various options, including a potential sale of the restructured business back to its current owner, Aurelius.

Next's potential purchase would likely not involve retaining most, if any, of The Body Shop's UK stores, many of which have already been closed as part of restructuring efforts.

These closures, along with head office downsizing, are expected to result in significant job losses.

The Body Shop, known for its ethical and environmentally conscious branding, has struggled with profitability in recent years.

While the brand retains a recognisable presence, its future remains uncertain as various parties consider its potential path forward.

Tash Van Boxel, from leading data and analytics company GlobalData, offered insights on the potential implications of the situation.

“Next's potential acquisition of The Body Shop would be different to that of its previous acquisitions as the IP and the brand would not be on offer under the current deal with the administrators for The Body Shop,” said Van Boxel.

“In the past, Next has brought in brands, such as Fat Face and Joules, and sold these on its website and even in-store under its own proposition, but as buying the brand is not currently possible, it is unclear as to what Next would be wanting to do with a potential The Body Shop acquisition.

"Indeed, Next already has a strong store network, and it is unlikely that the smaller-format The Body Shop stores would be appealing to Next, and this would also be going against the pattern which Next has already established with past acquisitions.”

Van Boxel also commented on the broader impact on the retail and health and beauty markets.

“In terms of the broader impact on the retail market, and health and beauty, it is unlikely that The Body Shop’s demise will have a large influence, given that much of the press coverage concerning The Body Shop is due to the nostalgia of the brand, and name recognition given the heritage of The Body Shop, rather than the retailer having a large impact on market size and market growth.”