Brazil-based beauty conglomerate Natura & Co is exploring strategic alternatives, including the possible sale of its wholly-owned subsidiary, The Body Shop.

The announcement comes after The Body Shop posted second quarter (Q2) fiscal year (FY) 2023 net revenues of 800m reais ($163.89m), down by 12.5% in constant currency terms.

During the quarter, combined sales of the brand’s core business distribution channels, including stores, e-commerce and franchises, also declined by mid-single digits in constant currency terms.

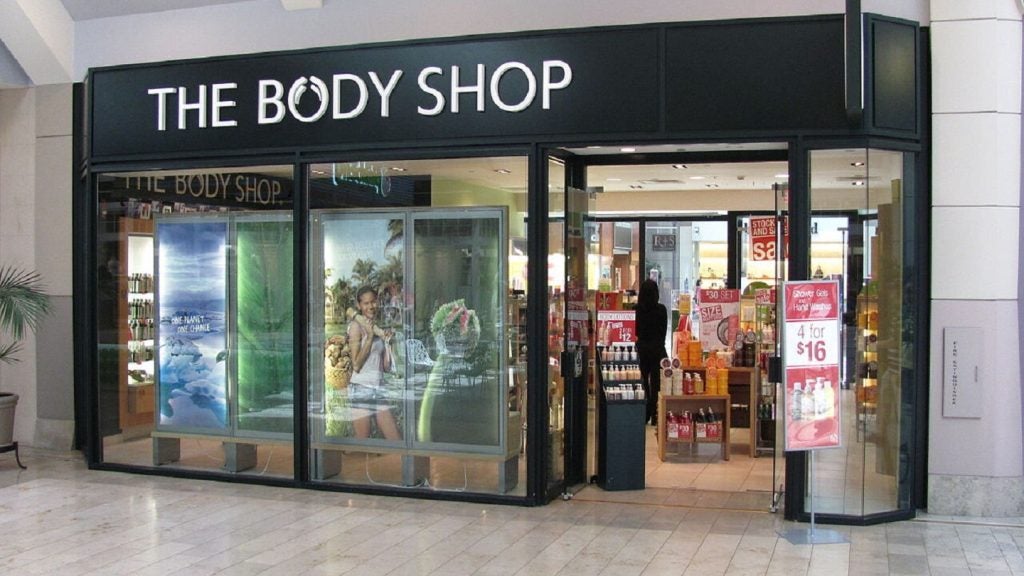

As of the end of Q2 FY23, The Body Shop operated a network of 2,368 stores, including 937 own stores and 1,431 franchise stores.

In its Q2 earnings release, Natura noted that every aspect of The Body Shop’s business was being fundamentally reassessed since Ian Bickley’s arrival as CEO.

The business is also focused on structural cost reduction and strict cost containment measures.

In a filing, the company said: “There can be no assurance that this process will result in any transaction. Natura does not intend to comment on or provide updates regarding this matter unless and until it determines that further disclosure is appropriate or required based on the then-current facts and circumstances.”

In 2017, Natura acquired the brand from French personal care company L’Oréal in a deal valued at €1bn ($1.08bn).

The company also owns the Avon and Natura brands. In April this year, it agreed to sell its Aesop line to L’Oreal for an enterprise value of $2.52bn.