Winning more Boomers spend could play a key role in the recovery of John Lewis and Waitrose after they announced plans for 11,000 job cuts over five years, in the wake of rising costs, a slump in sales and a full-year loss of £230m in 2023.

Matt Piner, Retail Research Director at GlobalData, commented: “Having had the upheaval of the pandemic, consumer shopping habits are now continuing to evolve in response to the cost of living crisis. A third of consumers globally have stopped buying certain products altogether because they are becoming too expensive, while 49 % are switching to cheaper brand alternatives, according to GlobalData research.

“However, whilst Boomers are part of this thrifty trend, they remain a group of comparatively cash-rich shoppers out to enjoy themselves, and hence a lucrative group for esteemed brands like John Lewis and Waitrose to target.”

Baby Boomers or Boomers were born between 1946 and 1964, with their ages now ranging from 59 to 77. Baby Boomer spend has been pivotal in propping up overall spend, particularly with Gen X and Millennials feeling the continued bite of the global cost of living crisis, with ongoing rent and mortgage payment hikes, high food and fuel inflation, and slow wage growth.

Piner continued: “Recognising and responding to the disparate ways that different generations shop is a key challenge for retailers, particularly when it comes to getting shopper attention. While it may currently be the done thing to channel huge proportions of marketing spend to sponsored TikTok and Instagram posts, this isn’t necessarily going to cut through to older, potentially very lucrative consumers, and there are other things more traditional retailers like John Lewis and Waitrose can do to keep winning their spend.”

Three ways retailers can win with Boomers

- Provide plenty of product information on websites and apps

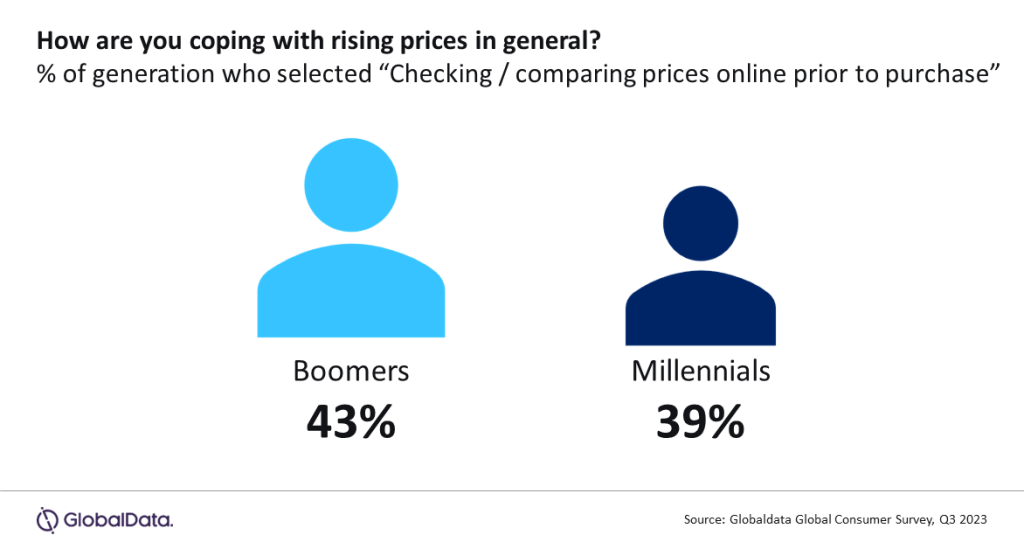

While Gen Z are seen as the native residents of the internet it is Boomers who generally have a lot more time to spare and, when it comes to shopping, they are digitally savvy and like to spend that time researching before they buy. In GlobalData’s Q3 2023 consumer survey, 43% of Boomers versus 39% of Gen Z confirmed that they checked/compared prices online prior to purchase. What’s more, Boomers are more likely to engage with ratings and reviews; it’s no coincidence that review listings are full of the phrase, “I bought this for my grandkids”.

- Build long-lasting relationships

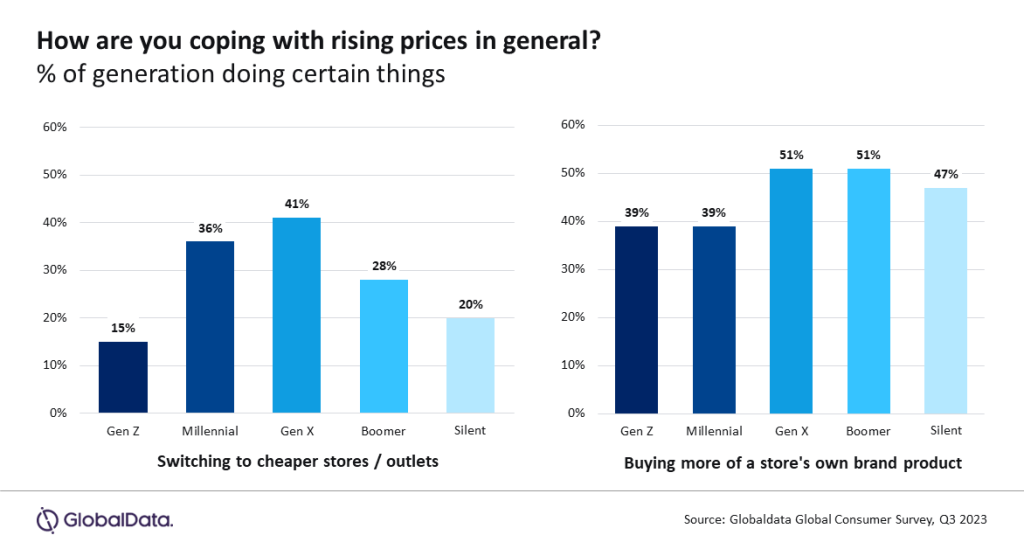

Over time, Boomers and their favoured brands have built solid and long-lasting relationships. Even when faced with rising prices, Boomers are less likely than Millennials or Gen X shoppers to trade down to cheaper stores, despite being more than happy to switch to their store’s own brand products. This boosted the likes of M&S over Christmas and has been a traditional strength of John Lewis and something the department store needs to get back to, even as it looks to modernise and evolve.

- Quality products, quality service, best possible price

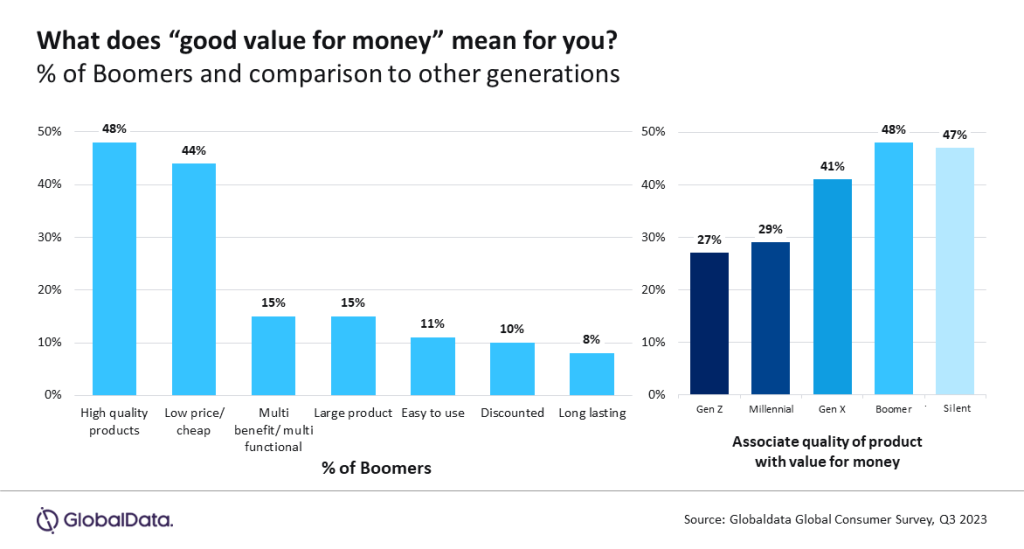

Boomers value quality. In GlobalData research, when asked about their associations with value for money across a range of products, Boomers were most likely to pick out the quality of a product – this from a generation who have adopted the phrase “they don’t make’em like they used to” from their parents. Although, as with every demographic, this doesn’t mean that they are agnostic about prices. Having moved away from its famous ‘Never Knowingly Undersold’ tagline, John Lewis needs to find other ways to reassure Boomers they are getting good value, as well as getting back to its traditional reputation for unrivalled customer service.

Piner adds: “Boomers are neither fickle nor easily won over. They do their research, are loyal and prioritise quality over all else, but still want a bargain. They aren’t attracted to gimmicks or agendas and gravitate towards trustworthy brands that do the basics well. For those companies able to meet these demanding criteria, the loyal custom of a well-off demographic is a more than worthwhile reward.”

GlobalData Consumer Custom Solutions offers sector-level expertise in the Beverages, Food, Retail and Packaging industries. We use our unique data, expert insights and analytics to answer your bespoke questions with a tailored approach and deliverables. To learn more or have a chat, just drop us an email at consulting@globaldata.com or contact us here, and we'll get in touch!