Theft and shrinkage of goods is one of the enduring problems faced by retailers globally. However, recent months have seen a spate of news stories about more eye-catching crimes, including daytime flash mob robberies.

UK police had to intervene with dispersal orders and make arrests in response to online videos urging crowds to turn up and cause disruptions in London’s West End shopping district. In the US, mob attacks on a Nordstrom store in Los Angeles and in other parts of California including Nike, Apple and Lululemon stores have left the industry grappling with heightened concerns about how to improve security in and around their stores.

Locking or removing merchandise from the shop floor

One way of doing this is to lock up or remove the merchandise from the shop floor. Walgreens is currently experimenting with new store formats such as its recently opened ‘digital-first’ experimental store in Chicago, with minimal merchandise in its physical aisles. Products typically carried by the drugstore chain — cosmetics, alcohol, baby care and gift cards — are now only accessible through a kiosk system in the store by using a tablet to place orders. These are then collected by an associate from behind the counter and packed for pickup. Ulta and Dollar Tree along with other retailers, are putting up plexiglass cases and using steel cables to lock down merchandise whilst adding security and large alarm systems to their stores.

Anoop Kumar, Retail Consultant Consumer Custom Solutions at GlobalData, comments: “In many ways, it feels like we are heading to a retail landscape more familiar to shoppers in the 1920s than the 2020s with merchandise presented behind glass-fronted counters that customers point at for store staff to retrieve and hand over to them. If this is where the future of retail is heading then it is in big trouble because one of the driving factors of store footfall and the appeal of the store shopping experience is that shoppers get to touch and examine the merchandise at will. If they can’t do that then they may as well shop online.”

Suffice it to say that retail crime has become a much more visible issue with retailers like Target and Footlocker pegging losses and a significant drop in gross margins due to it at millions of dollars. In the UK, clamour for tougher legislation against violent retail theft has grown with bosses at 88 retailers writing to the government for tougher sanctions against repeat and violent offenders. However, according to the recently published ‘Retail Security Survey’ by the US National Retail Federation, while total retail shrink is not an insignificant problem at more than $112bn, retailer bottom lines are about the same as they have been for a number of years.

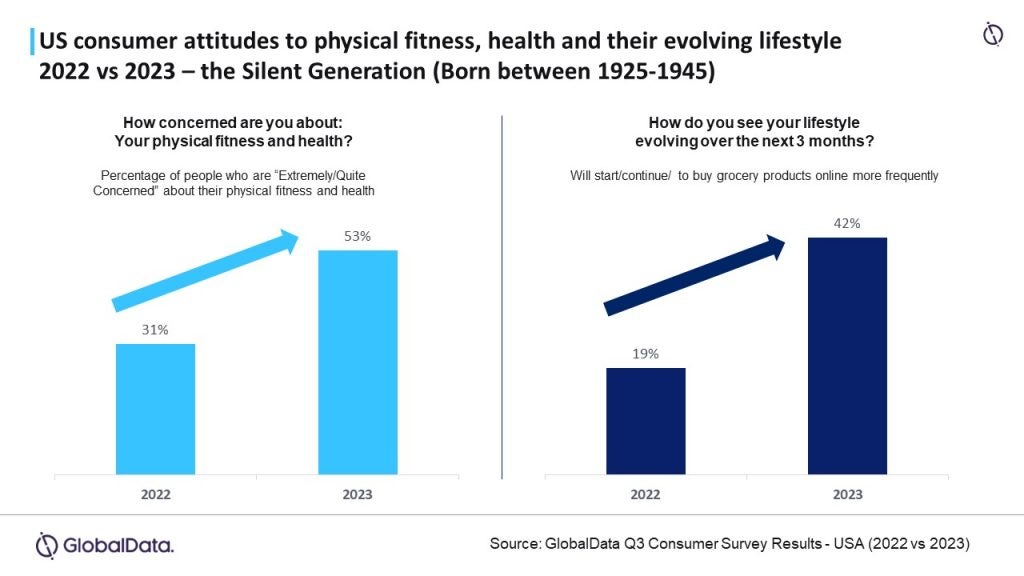

Sadly, one answer to the problem of store theft is to close them down altogether which some retailers have done in the interests of staff and customer safety. Target announced in September that it would close nine stores across the US, due to 'theft and organized retail crime threatening the safety of our team and guests.' The current situation could lead to more older shoppers abandoning their regular trips to the shops. GlobalData’s latest US consumer survey shows that older generations have grown more concerned about their physical fitness and health over the last 12 months from 31% of respondents in 2022 to 53% in 2023 and those shopping online more frequently have also doubled from 19% to 42% over the same period.

Kumar continues: “If nothing changes, more retailers are likely to close stores due to safety concerns, which will impact older generations who depend on in-store shopping the most. Post pandemic there is an increasing concern among older shoppers about their physical well-being - albeit, while shopping, it’s the threat of getting infected that drives this concern - however an increasing wave of violent retail crimes will encourage many older shoppers to choose other retailing options such as online shopping a channel they are already increasing their use of.”

Using technology to counter security concerns

Retailers are now increasingly turning towards technology to address some of the security challenges to their assets. Advanced surveillance systems and AI-powered analytics are becoming commonplace, such as Radio Frequency Identification (RFID) technology used for accurate inventory tracking. Australian supermarket chain Coles is adopting more modern technology solutions to combat store theft, including overhead cameras, trolley locks, smart gates, and fog machines. Tesco is investing heavily in security including bodycams for its workers, after physical assaults on them rose by a third this year. Autonomous robots and drones are now being employed by retailers such as BJ’s, Lowe’s, and IKEA to monitor everything from tracking inventory, patrolling parking lots, and ensuring the safety of stores, customers and employees.

The downside impact on customer service and sales

While the countermeasures to theft no doubt help to minimise losses, they can also have a significant impact on customer service and the shopping experience. Heightened security measures can create an atmosphere of distrust, making genuine customers feel scrutinised. Moreover, stringent inventory controls can lead to delays in restocking and longer checkout times, potentially frustrating shoppers. The emphasis on surveillance and technology might also divert staff attention away from customer interaction, impacting the personalised experience that many consumers seek. FMCG suppliers will be concerned because the practice of locking up merchandise or keeping stock in separate fulfilment areas significantly reduces impulse purchases and customer purchases in general due to its inconvenience. These measures will also hinder in-store brand development strategies through displays, merchandising, POS and other promotions.

Striking a balance

Kumar adds: “The battle against instore theft and shrinkage remains an ongoing challenge for retailers globally. While the adoption of advanced technologies is pivotal in tackling the issue, a delicate balance must be struck to maintain customer service, sales and margins. As the retail landscape continues to evolve post-pandemic and through this inflationary period, stakeholders must collaborate to find holistic solutions to this current crime wave that minimises stock theft, safeguards shop workers, and continues to deliver a great customer shopping experience.”

GlobalData Consumer Custom Solutions offers sector-level expertise in the Beverages, Food, Retail and Packaging industries. We use our unique data, insights and analytics to answer your bespoke questions with a tailored approach and deliverables to meet your budget, timeline, and specific scenario. To learn more or have a chat, just drop us an email at consulting@globaldata.com or contact us here: https://lnkd.in/gkakAxdm and we'll get in touch!