The in-person, physical retail market is expected to grow by 5.1% in 2024 as interactive experiences drive consumers back into stores.

Despite talk of ‘the death of the high street’, the physical retail market grew by 3.9% to $1.76trn in 2023, according to GlobalData’s new Future of Physical Retail report.

The report authors noted that physical retail had seen growth post-pandemic as “consumers continued to make the most of shopping in stores, especially for items where seeing and testing the product is important.”

They predicted that 2024 will bring further success for the instore market, as interactive technology looks set to become a key trend across sectors, offering instore experiences unrivalled by online shopping. In particular, augmented reality (AR) and virtual reality (VR) will shape customer interest, enabling product try-ons and interactive displays.

Explaining the potential impact of this burgeoning technology on retail, the report states: “AR and VR applications seamlessly blend the physical and digital realms, providing consumers with a futuristic and engaging shopping experience that goes beyond traditional physical shopping journeys. The technologies can also help reduce problems associated with purchasing online, enabling consumers to better see if an item will fit and suit them.”

It offered the example of Tommy’s Hilfiger’s collaboration with AR fashion try-on company Zero10 in March 2023. AR mirrors enabled consumers to virtually ‘wear’ highlights from the brand’s exclusive collection, whilst animated effects added to the aesthetics of the experience.

The future is here: introducing our latest solution for physical retail 💥

— ZERO10: The Future Of Fashion (@zero10_ar) March 24, 2023

For the first time ever, we bring the AR Mirror to global Tommy Hilfiger retail stores.

Already available in London! pic.twitter.com/ewm6Y0hZox

New Balance followed suit in July 2023, opening a concept store in Singapore which included an integrated 3D foot scanner. The scanner uses AR technology to identify the best-fitting shoes within five seconds to offer a speedy and accurate shopping experience.

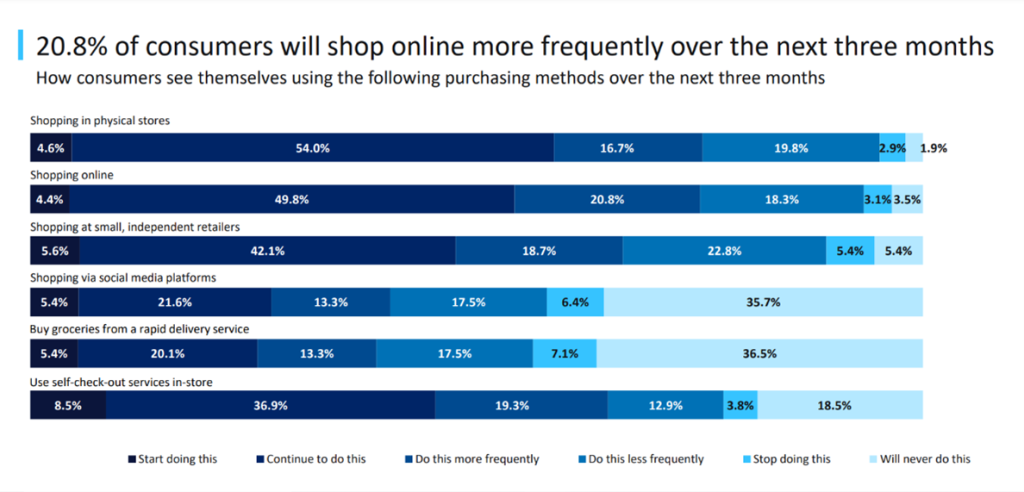

However, GlobalData’s 2023 Global Consumer Survey identified that both physical and online retail are important to shoppers depending on specific needs. 54% of consumers will continue to use physical stores compared to 50% online, and 17% of consumers will shop instore more frequently compared to 21% online.

Considering this, the report suggested that there are two major purchase motivations shaping consumer retail habits: urgent and considered.

‘Urgent’ purchases are “where convenience appeals for essential items such as food and groceries and some health & beauty items,” while ‘considered’ purchases are “for discretionary items such as clothing & footwear and in particular bigger ticket products such as electricals and furniture & floorcoverings.”

Both physical and online retailers have the opportunity to capitalise on these behaviours, by offering quick commerce, vending machines, collection points or other immediate solutions for urgent purchases or providing in-person experiences for considered ones.