Canada's book and lifestyle retailer Indigo Books & Music has announced the receipt of a non-binding proposal from Trilogy Retail Holdings and Trilogy Investments, collectively known as Trilogy.

Trilogy proposes to acquire all outstanding common shares in Indigo that it does not currently own for $2.25 per share in cash.

Trilogy and its joint actors currently hold 60.63% of Indigo’s common shares, amounting to 16,774,665 shares.

Trilogy is controlled by Gerald W Schwartz, a member of Indigo's board of directors.

The board is set to review the proposal to ascertain the best course of action for the company and its shareholders.

A special committee of independent directors has been formed to evaluate the offer and explore viable alternatives. It will oversee an independent valuation of the proposal.

Meanwhile, the board has advised shareholders and potential investors that no decision has been made regarding the company's response to the proposal.

The proposal is non-binding and there is no certainty that the transaction, or any other, will be concluded. Shareholders are advised that no immediate action is required on their part regarding the proposal.

The proposed transaction would be subject to the approval of a majority of minority shareholders, in accordance with Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions.

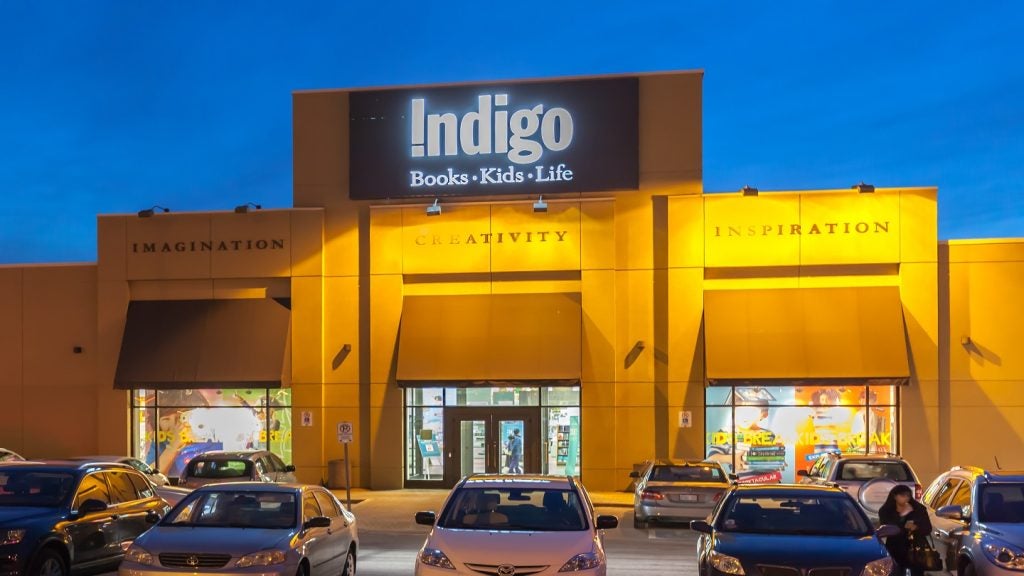

Indigo offers a curated assortment of books, home, fashion, gifts, wellness, paper, baby and children's products.

It operates retail stores in all ten provinces and one territory in Canada, and in the US, through a wholly owned subsidiary.