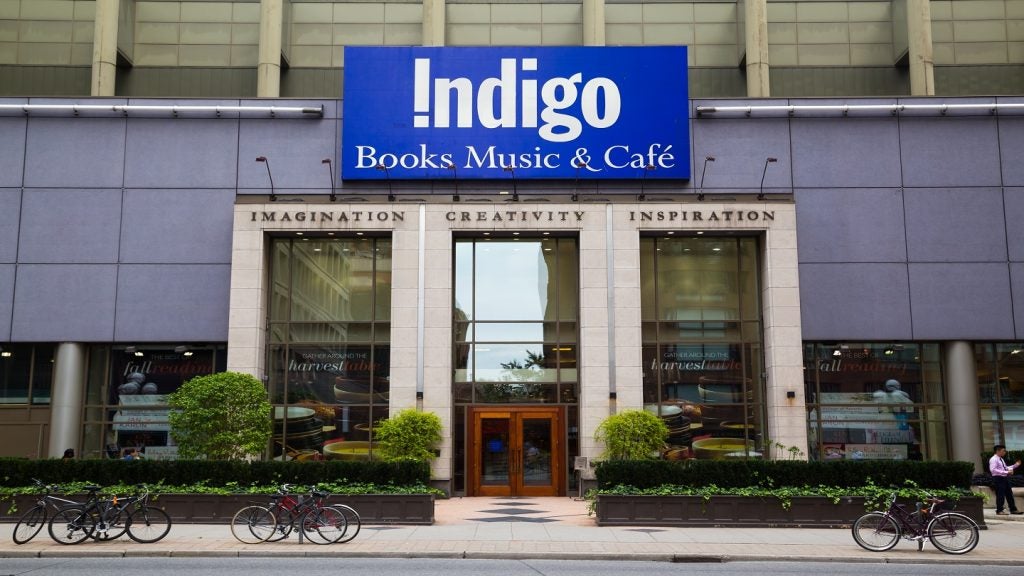

Canadian retailer Indigo Books & Music has agreed to be taken private after formalising an agreement with Trilogy Investments LP (TILP) and Trilogy Retail Holding Inc (TRHI).

TILP and TRHI are collectively referred to as Trilogy.

TILP will acquire all the issued and outstanding common shares of Indigo that Trilogy and its associates do not currently own for C$2.50 ($1.85) in cash per share, an increase from its initial offer of C$2.25.

The acquisition is based on the unanimous recommendation of an independent Special Committee of Indigo's board of directors.

Headquartered in Toronto, Canada, Indigo has stores across all ten provinces and one territory along with a store in Short Hills, New Jersey, US.

Trilogy and its affiliates hold 60.6% of Indigo's issued and outstanding common shares, which amounts to 16,774,665 shares.

The announcement follows negotiations that began after Trilogy’s initial non-binding proposal on 1 February 2024.

The agreed purchase price represents a 69% premium over Indigo's closing share price on the Toronto Stock Exchange on that date.

Indigo board and special committee chair Markus Dohle said: "Following careful consideration of a wide variety of factors and negotiations with Trilogy that resulted in a material increase to the price first offered to minority shareholders of Indigo, the Special Committee has determined that the transaction is in the best interests of Indigo and its minority shareholders.

"We believe that this transaction will provide minority shareholders with a substantial premium for their shares following some challenging years for the business, while also ensuring a strong future for Indigo with full ownership by a team that has demonstrated a deep commitment to Indigo's mission."

The completion of the deal is contingent upon the approval of the minority shareholders and other standard closing conditions.

The transaction will close in June 2024, after which Indigo's common shares are expected to be delisted from the Toronto Stock Exchange.