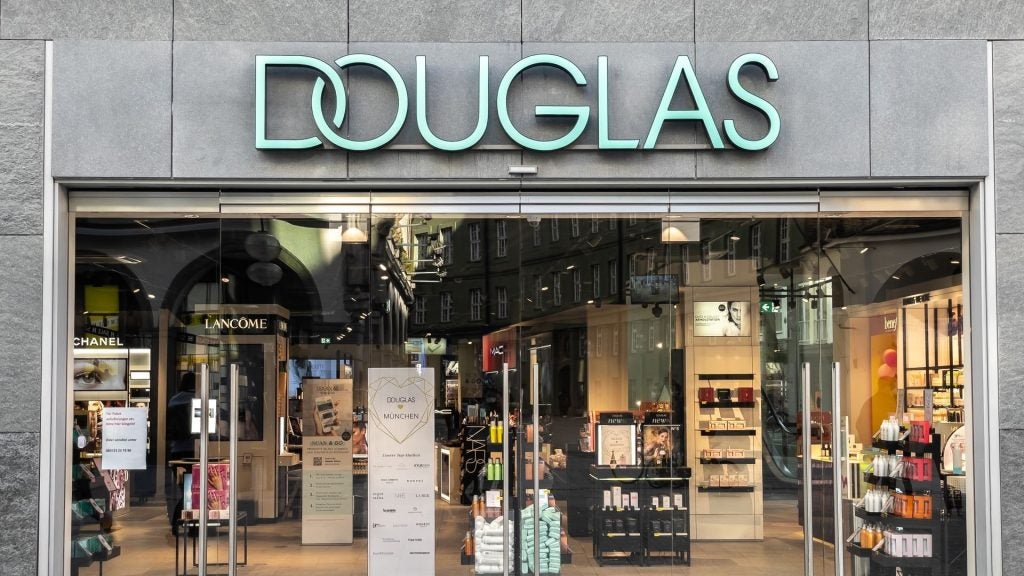

German beauty retailer Douglas, majority-owned by private equity company CVC, has announced plans to list on the Frankfurt Stock Exchange, the Financial Times (FT) reported.

The company aims to raise €1.1bn ($1.19bn) to support its growth strategy and potentially reignite Europe's sluggish initial public offering (IPO) market.

Targeting €6bn valuation

Douglas, operating more than 1,800 stores across Europe, seeks a €6bn valuation, potentially becoming Frankfurt's largest IPO since 2022.

The FT said the company plans to issue €800m in new shares, with existing shareholders contributing an additional €300m.

Capitalising on online growth

Despite recent challenges in Europe's IPO market, Douglas is confident.

According to the FT, Douglas CEO Sander van der Laan views the IPO as a springboard to "leverage our full potential," targeting €5bn in sales by 2026.

He is confident Douglas can outperform the broader European beauty market, driven by the company's strong online presence.

Frankfurt IPO awaits

Douglas' move follows the successful Frankfurt listing of German defence contractor Renk last month.

Other potential European IPO candidates this year include luxury brand Golden Goose and dermatology company Galderma, both backed by private equity businesses.

Investor feedback for Douglas' IPO has been positive, signalling a revival for European IPO activity.

CVC, aiming to deliver returns to its investors, plans to use the IPO proceeds to reduce Douglas' €300m annual interest payments and improve profitability.

Douglas' Frankfurt IPO filing could mark a turning point for European IPOs.

The company's growth strategy, combined with positive investor sentiment, positions it well for a successful listing.