Black Friday is a predominantly online affair, and for non-food retailers suffering amid the cost-of-living crisis, this promotional event will have been hoped by many to be the catalyst needed to rejuvenate online performance. Online non-food sales declined 9.3% in 2022 and are expected to be broadly flat in 2023. But 2023's Black Friday period has not been the boost to online sales retailers had hoped for, as shoppers shifted towards spending more in-store.

The proportion of UK shoppers who bought at least one item marked as a Black Friday discount rose marginally in 2023 (54.9% versus 54.7% in 2022), highlighting that although the popularity of the event has plateaued in recent years, it remains a core aspect of the festive period for many. However, while the proportion of spending that takes place online is high – Black Friday shoppers stated that 73.1% of their total spend was online in 2023 – this has fallen on previous years, down 1.6 percentage points compared to 2022.

The decline in the proportion of spending online was felt most in the clothing and footwear category, with the online share decreasing 10.8 percentage points to 56.2% in 2023. With more retailers in the sector now charging online return fees, fewer shoppers are purchasing multiple sizes to return the unsuitable ones after the event – deterred by the added costs incurred when doing this.

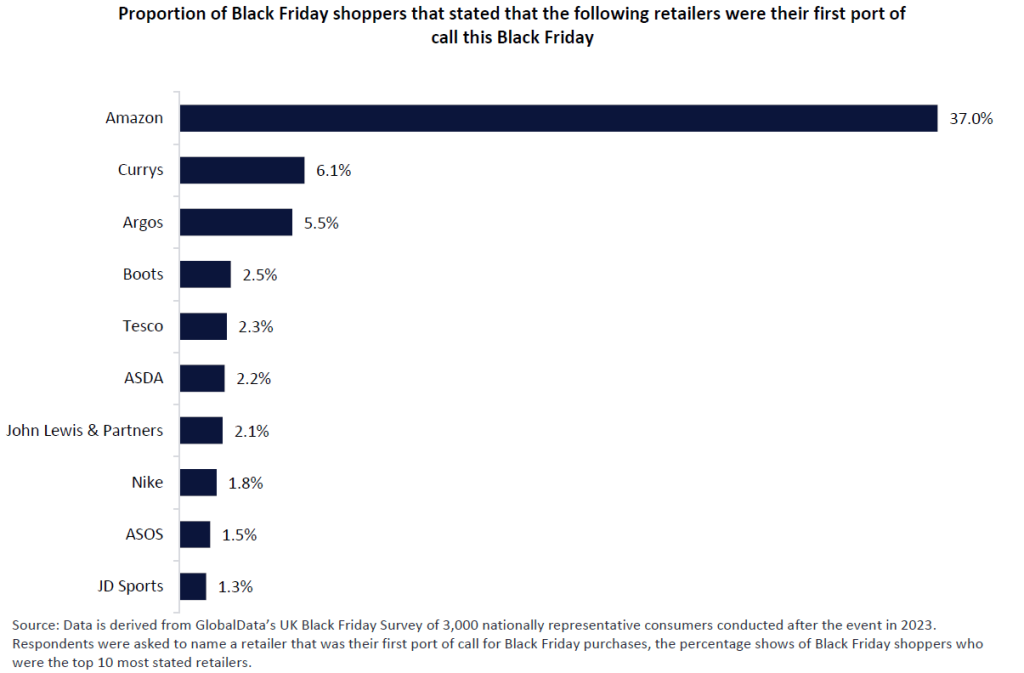

But the woes of weak online Black Friday performances are not evenly distributed across all retailers in the UK. Amazon remains the destination for many shoppers during the Black Friday period, with 37.0% of Black Friday shoppers stating the online giant is their first port of call for the promotional event. This is 6.3 percentage points higher than 2022 and significantly ahead of second-place Currys at just 6.1%. Amazon is cannibalising online sales during the promotional period with its ability to slash prices and keep delivery fees low for its Prime members. Indeed, the proportion of Black Friday shoppers who bought from Amazon was up considerably across all sectors.

For multichannel and other online specialists, the focus is on ensuring online operations are profitable, with some retailers increasing online thresholds for free delivery and charging for online returns recently to ensure online profits. In early 2023, Amazon announced it expected to achieve higher profits this financial year, likely linked to the increased delivery charges announced earlier. While it is unachievable for most retailers to emulate the giant's online proposition, for multichannel specialists, online platforms can be a tool to entice shoppers to stores over the period, encouraging consumers to try before they buy. Retailers can use stores to enhance the purchasing experience with events, such as those provided at John Lewis & Partners with Charlotte Tilbury make-up masterclasses, to encourage footfall and impulse purchases and simply offer something that Amazon cannot.