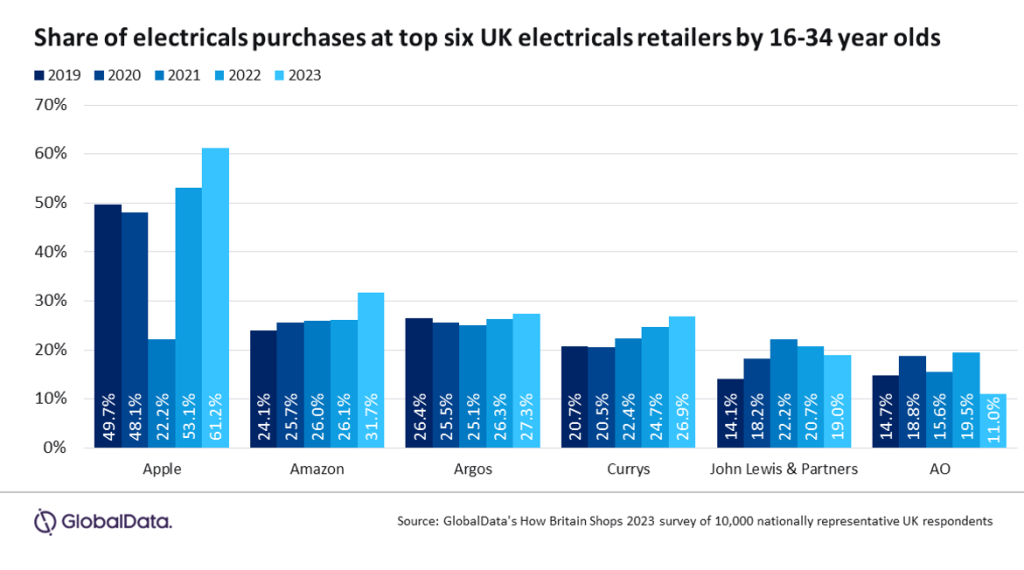

White goods supplier AO has a problem with young consumers. GlobalData’s 2023 How Britain Shops survey found that just 11.0% of AO’s customers were 16 to 34-year-olds, significantly below the 29.5% of total electricals shoppers and the lowest of the UK’s six largest electricals retailers for the last three years. Unless AO widens its appeal to younger consumers, it risks losing further ground to competitors, including rival online pureplay electricals specialists such as Appliances Direct and the up-and-coming Marks Electrical.

Despite its diversified range, AO’s continued association with its historical specialism in white goods is a key contributor to this underperformance, with young people less likely to own homes and therefore not responsible for the purchase and maintenance of such appliances. By contrast, Apple owes its significantly younger shopper base in large part to its focus on categories that generally skew towards younger consumers, including mobile phones and audio-visual items.

To properly cater to younger customers, AO must promote and improve its ranges in categories that have the highest relative penetration among 16 to 34-year-olds, namely personal care (31.3% penetration), portable audio equipment (18.7%) and video game consoles (17.5%).

Brand awareness is low among young consumers

Whilst AO achieved 10% annualised growth in overall spontaneous brand awareness in its results for the first half of the financial year 2023 to 2024 to 30 September, much of its advertising is poorly targeted towards young people, with an emphasis on TV advertising, despite a growing preference among younger consumers for alternative media sources such as streaming services over terrestrial television. Coupled with a declining advertising budget, this has meant that AO's brand awareness is low among younger consumers. Better targeting of its advertising resources towards new media will support awareness among these consumers.

In seeking to rebuild its profitability following the abandonment of its foray into the German market, AO has made itself less competitive in the cost and speed of its delivery services, both areas where competitor Marks Electrical is seen to outperform the rest of the market. By shifting its focus away from its fulfilment offering, it has adversely affected shoppers' perception of its online shopping experience and customer service, two significant consumer drivers which a higher share of 16 to 34-year-olds categorise as important than do those aged over 55. Re-investing in its delivery infrastructure should help on this front.