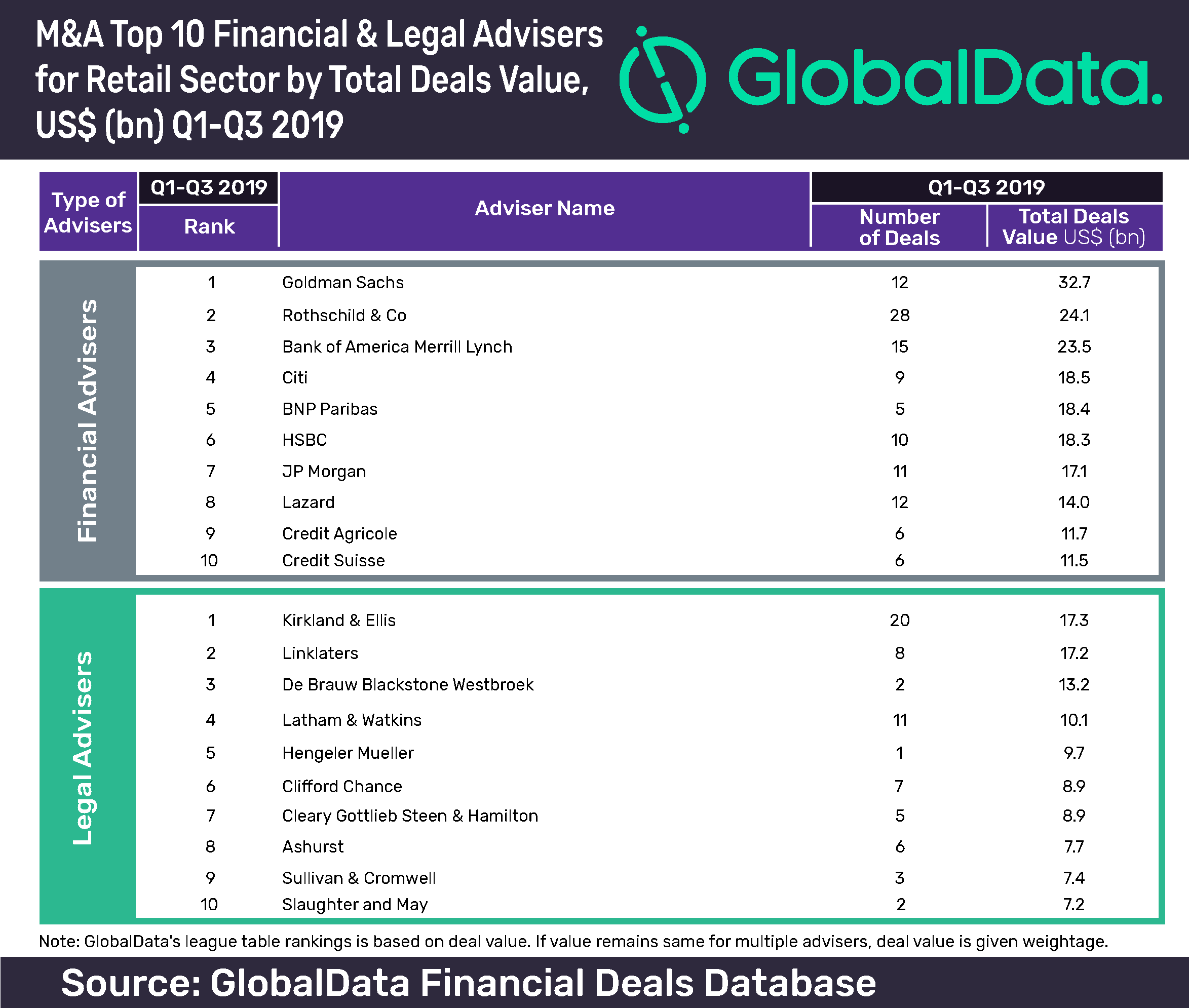

Goldman Sachs was the leading financial adviser globally for mergers and acquisitions (M&A) in the first three quarters (Q1-Q3) 2019 in the retail sector, according to GlobalData.

The American investment bank advised on 12 deals worth $32.7bn, including the big-ticket deal of EP Global’s acquisition of a 100% stake in Metro.

Goldman Sachs finished at the top position in GlobalData’s recently released GlobalData’s Q1-Q3 2019 ranking of top 20 financial advisers for global mergers and acquisitions.

In Q1-Q3 2019, Rothschild & Co was placed second with 28 deals worth $24.1bn.

GlobalData financial deals analyst Nagarjun Sura said: “Goldman Sachs emerged as the top financial adviser in the retail sector, whereas Rothschild settled in second position despite advising on 28 deals. Interestingly, Kirkland topped the legal adviser category in terms of volume and value.”

The retail sector saw a decline in deal value while volumes grew in Q1-Q3 2019 compared with Q1-Q3 2018. The total value declined by 2.07% from $118.43bn in Q1-Q3 2018 to $115.99bn in Q1-Q3 2019. Deal volume increased by 47.01% from 1,319 to 1,939.

Law firm Kirkland & Ellis emerged as the lead player in the list of top ten legal advisers, in terms of deal value. It advised on 20 deals worth a combined $17.3bn. Linklaters occupied the second position in terms of value, advising on eight deals worth US$17.2bn.

In the global league table of the top 20 legal advisers for Q1-Q3 2019, Kirkland & Ellis was placed second. The global league table was led by Wachtell, Lipton, Rosen & Katz.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.