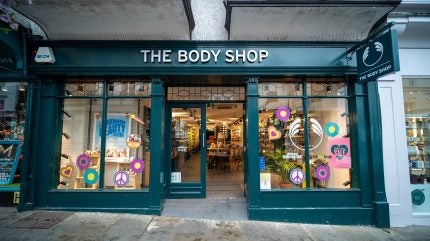

Ethical beauty brand The Body Shop has been saved from administration by a consortium led by British cosmetics tycoon Mike Jatania.

The announcement comes a month after Reuters reported that The Body Shop had signed an exclusive rescue agreement with a consortium led by the Auréa Group.

The acquisition includes the brand’s 113 UK stores and its operations in Australia and North America, safeguarding 1,300 jobs.

Auréa, a growth capital firm founded by Mike Jatania and former finance executive Paul Raphael, has bought The Body Shop International’s assets for an undisclosed sum.

The deal, finalised on 6 September 2024, aims to maintain the brand’s strong customer connection without closing any UK stores.

Founded by Anita Roddick in 1976, The Body Shop faced financial difficulties, entering administration in February 2024.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe previous owner, Aurelius, acquired the company for £207m late in 2023 but failed to turn it around, accruing debts of more than £276m.

Since the retailer administration, its administrator, FRP Advisory, has closed 85 shops, reducing the number to 113.

The Body Shop has also laid off 500 shop workers and 270 office roles.

While European and US stores have closed due to supply disruptions, most Asian outlets, operated by franchisees, remain open.

Auréa’s acquisition marks its largest transaction. It seeks to revitalise The Body Shop and re-assert its position as a leader in ethical beauty.

Mike Jatania will take on the role of chair, with Charles Denton, former CEO of Molton Brown, as chief executive.

The group is currently negotiating working capital, with restructuring firm Hilco reportedly providing £30m.

A spokesperson for Auréa was quoted by the Guardian: “We believe that the stores are an important part of the brand’s connection to its customers. We will naturally monitor the footprint of the estate to make sure that we are optimising performance through that connection.”