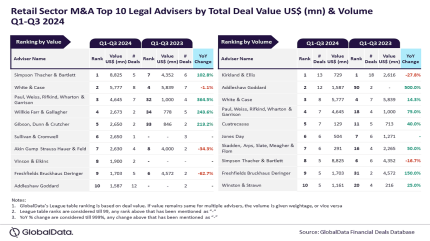

Simpson Thacher & Bartlett and Kirkland & Ellis have emerged as the leading mergers and acquisitions (M&A) legal advisers in the retail sector in the first quarter (Q1) and Q3 2024 by value and volume respectively, according to GlobalData’s latest league table.

GlobalData, parent of the Retail Insight Network and a leading data and analytics company, ranked advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, Simpson Thacher & Bartlett secured the top spot by deal value by advising on $8.8bn worth of deals.

Kirkland & Ellis dominated deal volume by advising on a total of 13 deals in the first three quarters of the fiscal year 2024.

GlobalData lead analyst Aurojyoti Bose said: “Simpson Thacher & Bartlett registered more than a double-fold jump in the total value of deals advised by it during Q1 to Q3 2024 compared with Q1 to Q3 2023. It went ahead from occupying the seventh position by value during Q1 to Q3 2023 to top the chart during Q1 to Q3 2024. The involvement in the acquisition of a 60% stake in Newland Commercial Management by a consortium of investors for $8.3 billion played a pivotal role for Simpson Thacher & Bartlett in registering a massive jump in terms of value and in securing the top spot by this metric.

“Meanwhile, Kirkland & Ellis was the top adviser by volume during Q1 to Q3 2023 and despite witnessing a YoY decline in number of deals advised, it managed to retain the leadership position by this metric during Q1 to Q3 2024.”

In terms of deal value, White & Case took second position by advising on $5.8 billion worth of deals.

The company was followed by Paul, Weiss, Rifkind, Wharton & Garrison with a deal value of $4.6bn, Willkie Farr & Gallagher by advising on $2.7bn and Gibson, Dunn & Crutcher with $2.7bn.

Addleshaw Goddard took second position in terms of volume by advising on 12 deals, followed by White & Case with eight deals.

Paul, Weiss, Rifkind, Wharton & Garrison also advised on seven deals each over the period.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To further ensure the robustness to the data, the company also seeks submissions of deals from leading advisers.