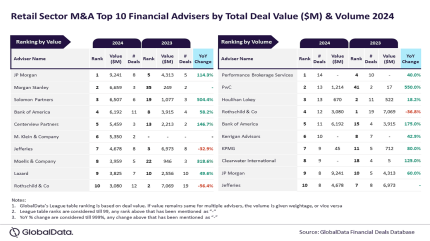

JP Morgan and Performance Brokerage Services have emerged as the leading mergers and acquisitions (M&A) financial advisers in the retail sector by value and volume respectively in fiscal 2024, according to leading data and analytics company GlobalData’s latest league table.

GlobalData, which is the parent of Retail Insight Network, ranked advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, JP Morgan held the top position in terms of deal value by advising on transactions amounting to $9.2bn.

Performance Brokerage Services was the leader in deal volume, having advised on 14 transactions over the year.

GlobalData lead analyst Aurojyoti Bose stated: “The total value of deals advised by JP Morgan more than doubled in 2024 compared to the previous year. And it went ahead from occupying the fifth position by value in 2023 to top the chart by this metric in 2024. Apart from leading by value, JP Morgan also occupied the ninth position by volume.

“Meanwhile, there was also an improvement in the total number of deals advised by Performance Brokerage Services and its ranking by volume improved from the fourth position in 2023 to the top position in 2024.”

Next in deal value was Morgan Stanley, with advisories on deals worth $6.7bn. Solomon Partners followed with $6.5bn. Bank of America had deal values of $6.2bn and Centerview Partners $5.5bn.

In terms of deal volume, Pricewaterhouse Coopers (PwC) claimed the joint runner-up position with advisories on 13 deals, matched by Houlihan Lokey. Rothschild & Co was responsible for 12 deals, while Bank of America facilitated 11 transactions.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.