UK-based retail brand owner Frasers Group has made a potential £83m ($111m) offer to acquire luxury handbag manufacturer Mulberry.

This comes after the handbag company recently announced its intention to raise gross proceeds of £10.75m to strengthen its financial position.

In the previous fiscal year ending 30 March, Mulberry reported a pre-tax loss of £34m, a stark contrast to the £13m profit from the previous year.

The company’s sales dropped by 4% to £152.8m, with a further 18% decrease recorded in the subsequent 25 weeks.

Frasers, which already holds a 37% stake in Mulberry, has stepped forward with the offer as the handbag manufacturer faces a sharp decline in the luxury market.

The group criticised Mulberry for the lack of communication regarding its fundraising plans, which it says were disclosed just before the public announcement.

According to a statement, Frasers Group said: “Given this total lack of engagement, we believe the status quo to be an untenable position for Frasers and the other minority holders of Mulberry shares.”

Frasers Group said that it plans to avoid a repeat of the Debenhams collapse, where Frasers also had a stake.

Debenhams fell into administration in 2019 after a prolonged period of declining sales, exacerbated by the Covid pandemic.

“We would not accept another Debenhams situation where a perfectly viable business is run into administration,” the statement read.

The board of directors of Mulberry has rejected the offer and said that the proposal “does not recognise the company’s substantial future potential value”.

Mulberry’s board also noted that Challice, the company’s 56.1% majority shareholder, has voiced no interest in supporting the possible offer.

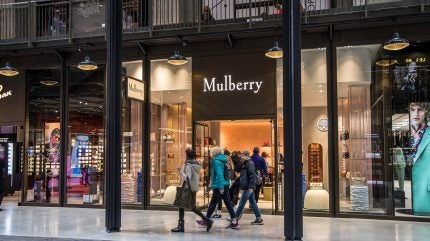

Headquartered in Somerset, Mulberry designs and manufactures leather goods including bags and other lifestyle accessories.

The brand offers its products directly to consumers in 190 countries through an integrated network of digital channels and stores.