The latest PwC Global Consumer Insights Pulse Survey offers valuable insights into the evolving shopping trends of consumers.

The survey highlighted the rise of cost-cutting behaviours, the continued growth of online shopping and the emergence of hybrid in-store experiences facilitated by digital touchpoints.

The survey also highlights supply chain disruptions and the challenges and opportunities retailers face in their pursuit of frictionless shopping.

As the year 2023 continues to unfold, consumers and companies face new challenges brought on by powerful internal and external forces.

According to the latest Global Consumer Insights Pulse Survey conducted by PwC, concerns over inflation and the cloudy macroeconomic climate are causing consumers to realign their shopping habits and adopt cost-cutting behaviours.

Despite these concerns, consumers are still eager to resume their pre-covid habits and are seeking seamless in-store and online experiences that better suit their lifestyles and pocketbooks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataConsumers plan to implement cost-cutting measures in some form

Headed by the report’s central findings, 96% of surveyed consumers intend to adopt some cost-saving behaviour over the next six months.

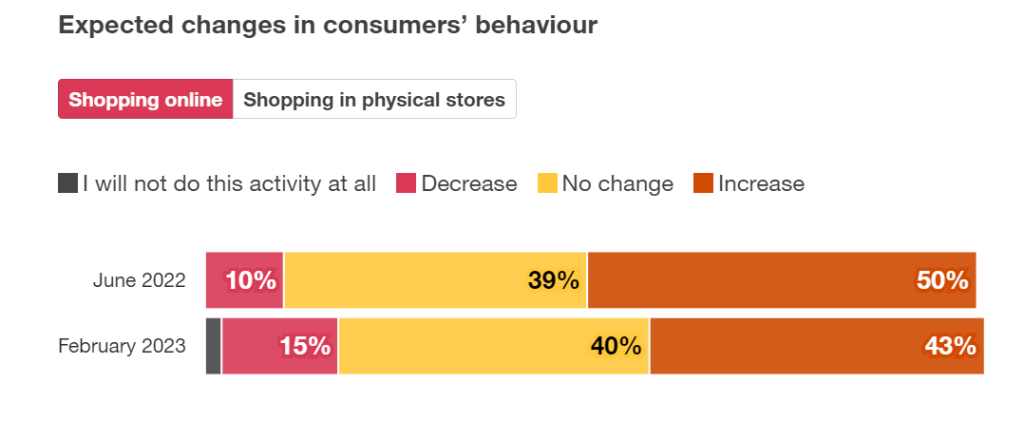

The survey results also showed that 43% of consumers plan to increase their online shopping in the next six months.

Additionally, in-store shopping has rebounded, with plans to increase shopping in physical stores dropping significantly from 33% to 23%.

The report identified four distinct consumer segments that have emerged due to the current economic climate and potential cost-of-living impact.

While more than 70% of consumers are willing to pay more for ethical practices and local products, 50% are very or extremely concerned about their financial situation.

A slow pullback

Smaller numbers of consumers are saying they plan to increase the amount of shopping they do online and in stores in the next six months.

Source: PwC’s June 2022 and February 2023 Global Consumer Insights Pulse Surveys

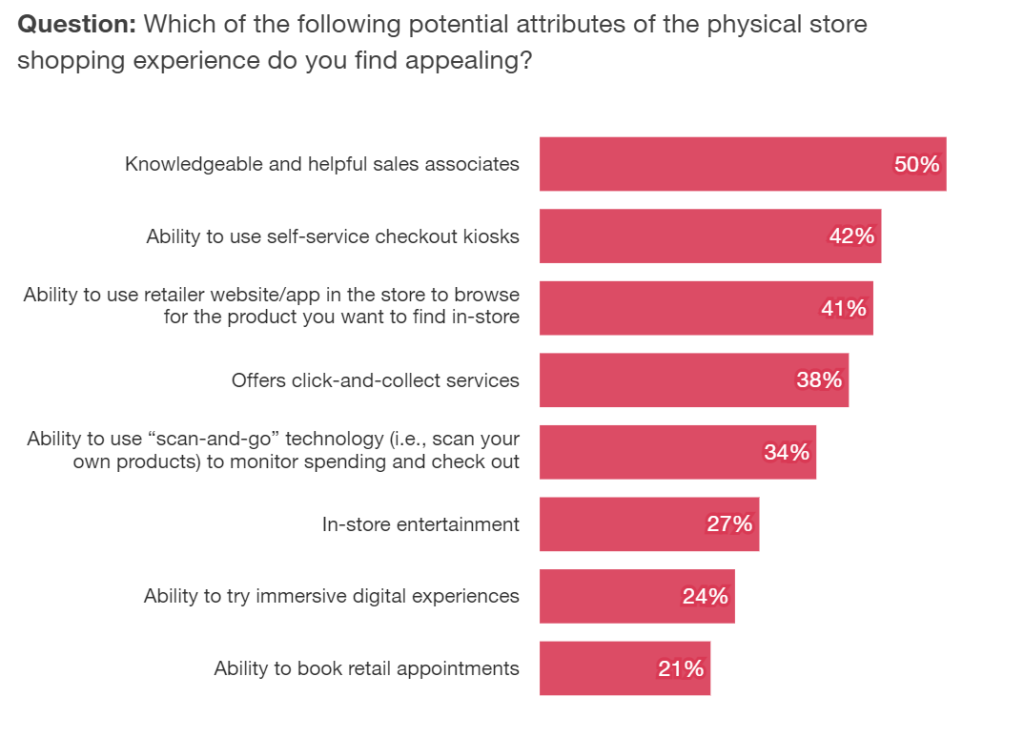

Consumers are seeking a more enriched in-store shopping experience with the aid of digital technologies

The survey also revealed that consumers are looking for an enhanced in-store shopping experience facilitated by digital technologies, with 27% of respondents ranking access to knowledgeable and helpful sales associates as the leading factor.

Consumers also indicated an attraction to in-store entertainment, immersive digital experiences and the ability to book appointments with sales advisers or personal shoppers.

Despite the growth of e-commerce during the pandemic, the report notes that consumers are not approaching where to shop as an ‘either-or’ proposition but as a ‘this-and-that’ set of options.

More than half of consumers who opt to shop in physical stores or to place orders online and pick up at the store do so because it offers them the ability to check that products are not broken or faulty and to be certain that they’re the products they ordered.

Ultimately, the survey makes it clear that companies must identify, isolate, and mitigate the many frictions that stand between them and their customers to ensure they’ll be able to meet them where they will be in the future.

Consumers seek physical and digital in-store experiences