The UK’s rapid-delivery market is reaching a period of maturity.

After in-store shopping surged post-pandemic and the cost-of-living crisis set in, rapid-delivery providers grappled with diminished demand and profit margins.

However, after a three-year decline, the UK’s online food and grocery market is forecast to achieve a 5.7% year-on-year growth in 2024, according to leading data and analytics company GlobalData.

For grocers, the long-awaited uptick in online sales and the market exit of smaller rapid-delivery players present a renewed opportunity within the rapid-delivery market.

The UK’s largest traditional supermarkets, Tesco, Sainsbury’s, Asda, and Morrisons, are also expanding their network of convenience stores.

These small-format stores double as an opportunity and foundation to extend their rapid-delivery reach to new locations and consumers.

However, grocers are going to have to work hard to encourage and engage new customers.

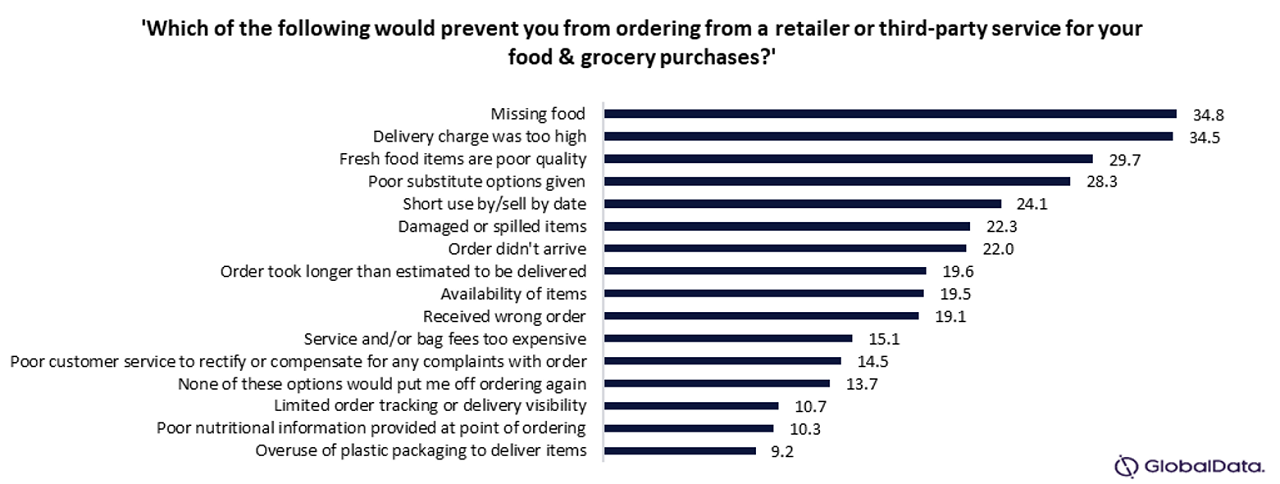

Consumers are worried about missing food, high delivery charges, and poor quality, with more than 75% of consumers citing that poor-quality items bought online would discourage them from placing an order with grocery retailers or third-party services.

Grocers must prioritise quality control checks, real-time product availability at the point of order, and improve inventory forecasting to reduce substitutions.

New and existing convenience store formats must be able to execute fast order picking and be strategically located in areas with established last-mile delivery services such as Uber Eats and Deliveroo.

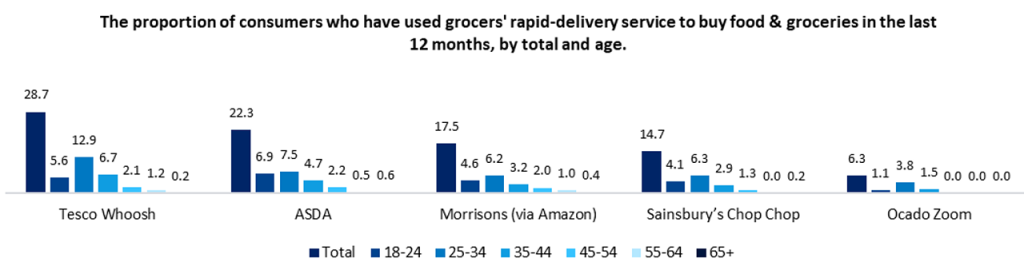

Tesco is currently the most-used grocer among consumers for rapid delivery.

Its success in appealing to a sizeable portion of the 25-34 age group (the most likely demographic to use rapid-delivery services, according to GlobalData research) can be attributed to its strong brand image and promotion of its ‘Whoosh’ deliveries over the past year.

In contrast, Ocado Zoom, which has the lowest penetration among grocers’ in-house expedited delivery services, has recently received several critical reviews via Trustpilot.

These reviews cite missing items and poor adherence to delivery timings, which could be damaging to loyalty and brand perception.

When these factors are compounded with failures to meet expectations for good quality and complete deliveries, grocers risk negative reviews and losing repeat spend.

For Asda and Morrisons, which trail behind Tesco in consumer penetration, using their respective convenience store openings this year for expedited deliveries will be essential to gain market share in the rapid-delivery market.

To enhance organic growth, grocers should raise awareness of their services with introductory offers in local areas to attract new customers.