The recent demise of The Body Shop, which held sustainability at its core, highlights that retailers need to do more than demonstrate solid environmental credentials to remain relevant to consumers. Sustainability must come hand in hand with accessibility, as high price points and complex refill stations remain barriers to ethical and eco-friendly health & beauty.

Innovation within the sustainable health & beauty market was driven by brands such as Wild and Estrid, with both brands starting as pureplays before creating partnerships with brick-and-mortar stores to improve accessibility. However, as sustainability is becoming more mainstream and less of a want and more of a need for some consumers, retailers have developed and expanded their own brand ranges to rival their often more premium competitors. This development in the market is crucial and should ensure own brand’s success because price and value for money are important to shoppers.

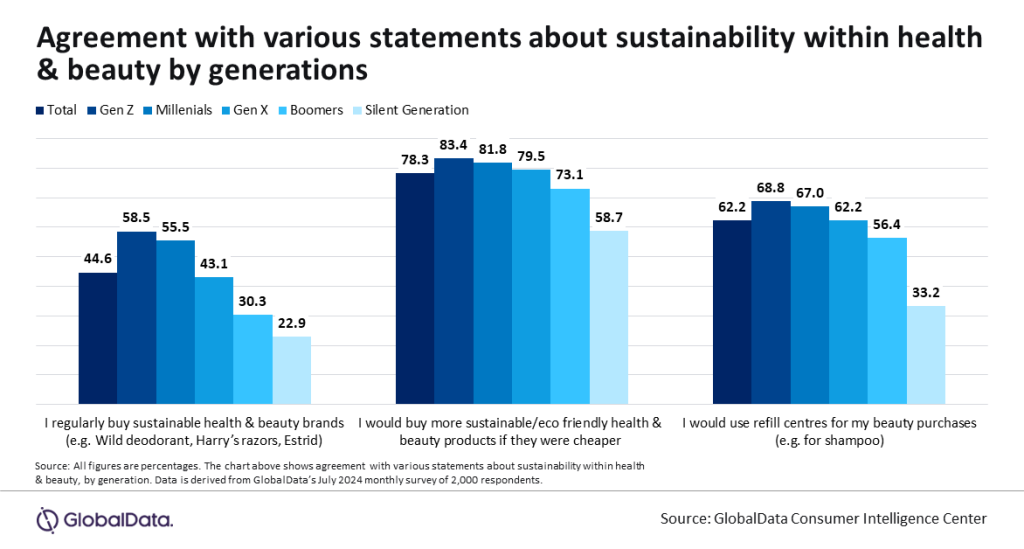

Price continues to be a barrier to entry for many consumers considering sustainable health & beauty, particularly younger consumers. 83.4% of Gen Z and 81.8% of millennials stated they would buy more sustainable/eco-friendly health & beauty products if cheaper. Retailers must target the younger demographics to promote sales of sustainable products, as these generations are the most likely to be repeat purchasers, with 58.5% of Gen Z agreeing that they regularly shop for sustainable health & beauty products and 55.5% of millennials stating the same. Retailers must ensure competitive prices so consumers can shop sustainably without choosing between ethics and affordability.

The accessibility of sustainable brands has improved, with shoppers buying these items conveniently from health & beauty specialists and supermarkets. However, one part of the sustainable market which remains less accessible is refillable health & beauty. 62.2% of UK consumers agreed that they would use refill centres for their beauty purchases, indicating that if more health & beauty specialists were to offer this feature, consumers would take advantage of it. This option would lessen the price barrier for purchasing sustainably, given that refills are often cheaper than buying an entire product new each time, enabling retailers to reduce waste while increasing demand. Moreover, refill stations tend to be individual to each retailer, meaning consumers will become repeat purchasers, bolstering customer retention. Wild has perfected its refillable deodorant product, enabling shoppers to buy refills in-store via its partnerships or online directly from its own website and then replace them at home with little fuss. In comparison, The Body Shop’s refill process forced shoppers to empty the product and bring the container to a shop to be able to refill it, decreasing the convenience of the process as it relies on consumers organising and remembering to do so in advance. Retailers must ensure simplified refill processes, enabling consumers to pick up a refill item during their shopping trip rather than having to undertake multiple steps in advance.