Key UK clothing retailers Next and Marks & Spencer (M&S) are in something of a pickle when it comes to their home offerings. In both cases, their clothing ranges have highly accessible price points, with shoppers being largely representative of UK consumers overall in terms of household income, but their home propositions skew towards less accessible price points.

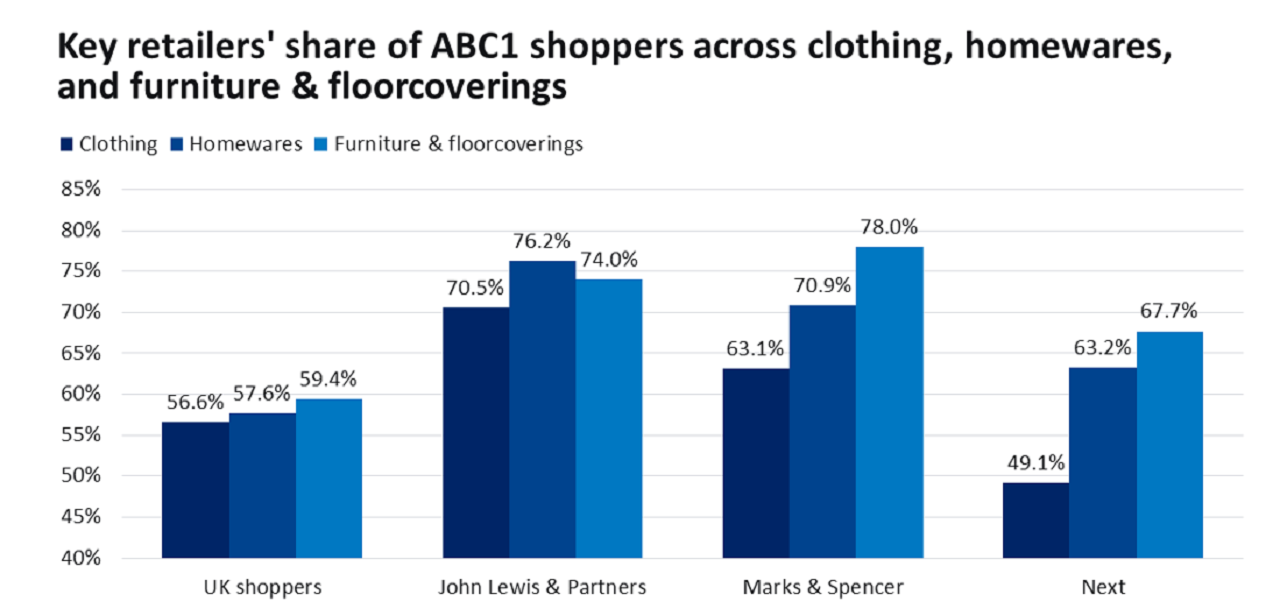

The generally higher average selling price of furniture in comparison to clothing means that it is somewhat inevitable that furniture shoppers are on average richer than apparel shoppers. This is, however, a rather small effect overall. 56.6% of clothing shoppers were in the ABC1 social grade in 2024 according to leading data and analytics company GlobalData’s How Britain Shops survey, whereas this was 57.6% for homewares and 59.4% for furniture and floorcoverings, a gap of just 2.8ppts between clothing and furniture and floorcoverings. John Lewis & Partners’ clothing and home offerings are both upper-mass market, so the retailer has a small gap between its clothing and home shoppers – the widest gap is between clothing and homewares, at 5.7ppts.

However, Next and M&S’ awkward price positioning across sectors means that for them the gap is wider, at 18.6ppts and 14.9ppts, respectively, between clothing and furniture and floorcoverings. This bifurcated price architecture has created issues in converting their mass-market apparel customers into more premium home shoppers, especially because of the effects of the cost-of-living crisis. Tellingly, out of the UK’s top ten homewares retailers, it is John Lewis and Next, who have the most premium home price points, that are forecast to lose the most share between 2022 and 2024, at 0.4ppts and 0.3ppts, respectively.

This mismatch was likely a factor in M&S’ exit from large furniture such as beds and wardrobes, and it will continue to be a sticking point for both retailers. To better convert their lower-income clothing shoppers into home shoppers, Next and M&S must focus on broadening the price architecture of their home offerings. The retailers’ growing brand portfolios will help them to accommodate different price points, with Next’s acquisition of Made.com giving it a premium range to go alongside a more accessible own-brand collection that still emphasises its quality and style credentials across all price points. As discretionary incomes rise, consumers will begin to put a greater emphasis on design and quality, which will play to the retailers’ advantage, but the fundamental mismatch will continue to limit their growth among certain consumers.