At Christmas 2023 it will be crucial for grocers to showcase their online capabilities by promoting the convenience of the service if they are to appeal to consumers stocking up on festive food later in the season who want to avoid the risk of poor availability and crowded stores. The UK online food and grocery market has fallen short of post-pandemic expectations, only returning to consistent month-on-month sales growth in the second quarter (Q2) of 2023, and we forecast that online sales of food and groceries will grow by just 2.0% in Q4 2023 compared to Q4 2022.

36.6% of consumers expect to use online channels for their Christmas food and drink shop this year, down from 41.4% in 2022, according to GlobalData’s 2023 Christmas Intentions report. 47.6% of those intending to shop online have already begun their Christmas shopping to spread the cost. Retailers such as Tesco, Sainsbury’s and Morrisons are on the front foot, opening up online order slots earlier than in previous years to gauge demand and manage order volumes in advance of the busy period.

One way to appeal to price-conscious consumers will be by following Sainsbury’s lead of offering value for money and low prices on key Christmas products through loyalty scheme discounts made available online. Along with this, highlighting last-order-by dates to avoid disappointment and ensuring the availability of crucial Christmas products is another key to success, as well as allowing for more flexibility to add to submitted orders and make amendments to substituted products ahead of delivery. The grocers must leave a good impression, and delivering an order with unexpected, substituted items at an important time of year is a sure way to deter future online adoption among shoppers.

One aspect of online shopping that should not be ignored is rapid delivery. Online has underperformed since the pandemic, but investment by Tesco in its Whoosh service shows that it is here to stay. Grocers must showcase the convenience and speed of rapid delivery services in the run-up to Christmas and offer loyalty scheme members money-off vouchers for rapid delivery orders. This will help to keep retailers front-of-mind for those looking to do last-minute top-up shops.

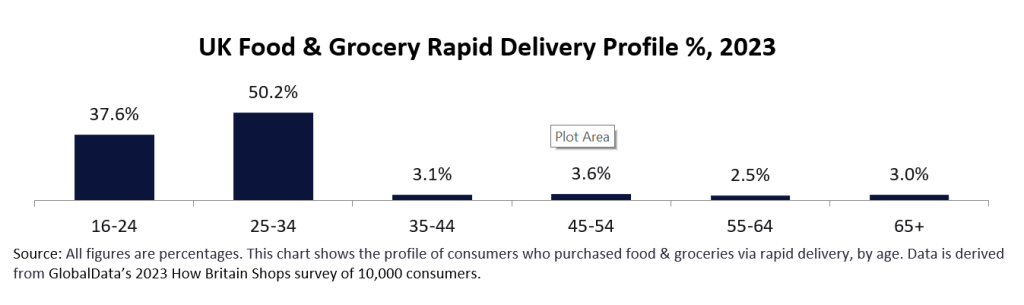

While rapid delivery is typically more popular with younger consumers aged 16 to 34 years (this age group made up 87.8% of food and grocery rapid delivery shoppers in the past 12 months), capitalising on the elevated levels of food shopping around Christmas will be a useful way to appeal to older consumers, by promoting the convenience and range of products available through rapid delivery options. To differentiate from other retailers, those offering rapid delivery should promote the availability of Christmas staples that consumers may have forgotten, such as cranberry sauce, as a way of demonstrating the convenience and reliability of the service and improving the chances of repeat spend.