Low uptake and complex logistics have hindered grocers’ expansion of refill stations, but finding a way to make these services viable is essential to gain shoppers in the future, as sustainability creeps up their priority list.

Most grocers have struggled to make their refill operations a success so far – Asda is the latest to announce that it is closing its refill stations, citing ‘cost, convenience, cleanliness, and perceived product quality’ as the reasons for this.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

While Asda’s initiative has been discontinued, Marks & Spencer has been steadily implementing its ‘Fill Your Own’ programme since 2019, expanding from three to 15 stores, with plans to reach 25 by the year’s end making it the market leader.

Compared to Asda’s customer base, which primarily consists of budget-conscious families, Marks & Spencer caters to an older and more affluent demographic that is more likely to have the financial resources to shop with environmental considerations in mind.

This indicates that like in the apparel industry where sustainability has progressed from being seen as a luxury for the affluent to becoming more accessible to the general population, the adoption of eco-friendly practices in the food and grocery sector is likely to follow a similar trajectory.

Grocers should thus view the implementation of refill stations as a long-term investment and prepare for future adoption, considering the logistical complexities involved in establishing these systems, which are likely to have contributed to previous setbacks, and trialling various options to overcome these.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the meantime, value and midmarket grocers should enhance their sustainability focus by expanding existing areas such as loose fruit and vegetables to reduce plastic packaging further and introduce reusable packaging options to prompt shoppers to reconsider their packaging choices.

Customer demographics are not the sole determinant of success, as evidenced by Waitrose’s ‘Unpacked’ initiative, which has been trialled in four stores since 2019 without any expansion.

While Waitrose has expressed intentions to scale up the programme in the future, its progress has been hindered by the need to focus on profitability and revenue generation in response to challenges such as the Covid-19 pandemic and the subsequent cost-of-living crisis.

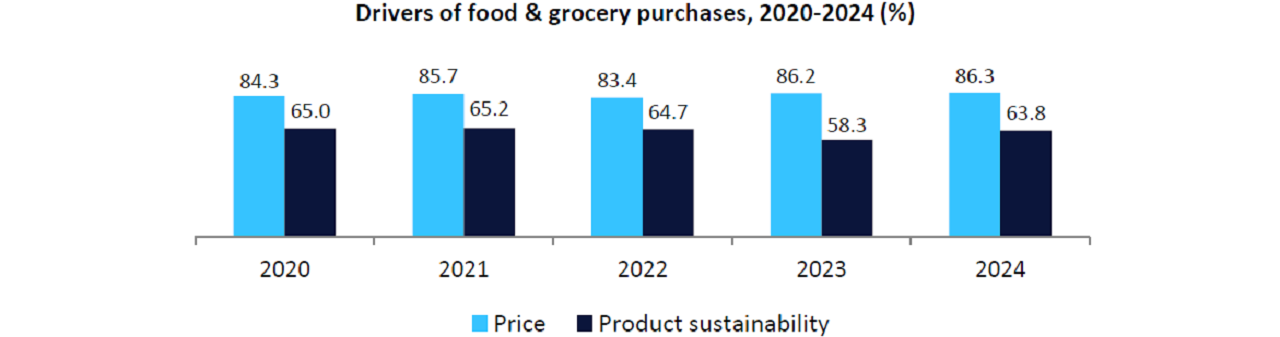

In 2023, when price gained importance as a driver of food and grocery purchases during the height of the cost-of-living crisis, product sustainability simultaneously became a lower priority.

However, while price remains of paramount importance this year, lower food inflation has meant that product sustainability has stepped back up as a consumer driver, increasing 5.5 percentage points on the previous year.

As food inflation slows and shoppers feel less financially restricted, we expect consumers to increasingly value sustainability and in time, start to utilise refill stations.

This trend is supported by the growing popularity of ‘restocking’, where consumers opt to transfer items from their original packaging into reusable containers, which aligns well with the concept of refill stations.

Grocers can capitalise on these trends by offering discounts to those who bring their own containers to refill stations, selling refillable containers to purchase, and providing non-plastic bags at the refill stations for first-time customers, which can further enhance grocers’ sustainability efforts and boost sales.