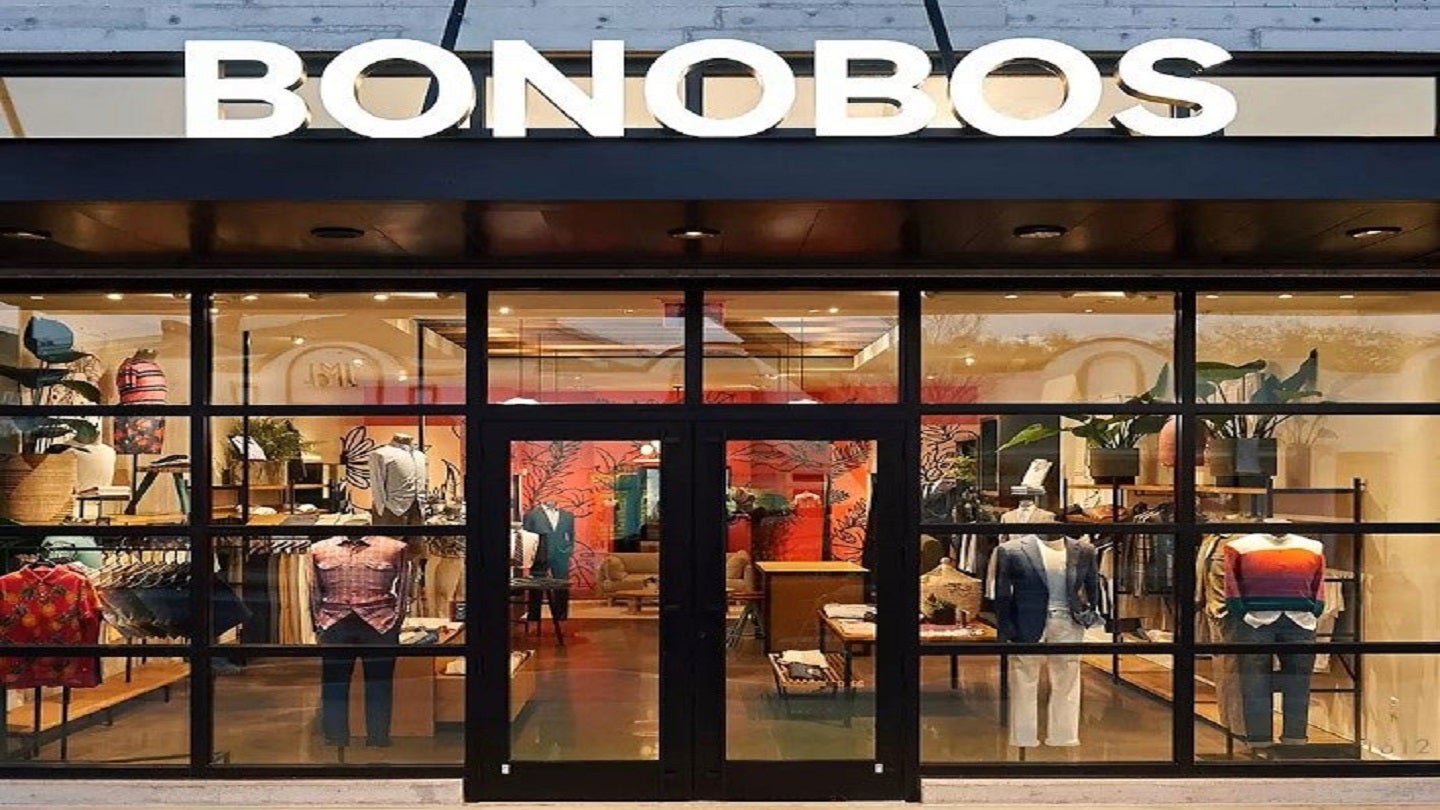

Fashion apparel retailer Express and brand management firm WHP Global have entered into an agreement with Walmart to buy the menswear brand Bonobos.

Bonobos was founded in 2007 and was acquired by Walmart in 2017.

As part of the $75m deal, Express will buy the operating assets of Bonobos and operate the company’s e-Commerce, guideshop and wholesale businesses in the US through an exclusive long-term licensing agreement with WHP.

Express expects the acquisition to expedite its sales growth and profitability.

The company plans to use Bonobos’ presence in the menswear sector to enter underpenetrated categories while driving awareness and customer acquisition.

Express chief executive officer Tim Baxter said: “Bonobos is delivering double-digit sales growth and we plan to continue that momentum while also realizing operating synergies and other economies of scale.

“This is a compelling addition to our brand portfolio and I expect the transaction will be accretive to operating income and free cash flow positive in fiscal 2023.”

The deal marks the first acquisition for the two companies since signing a strategic partnership earlier this year.

The company will complement Express’ portfolio of brands which includes Express and UpWest. It will continue to be headquartered in New York, US.

Bonobos CEO John Hutchison will continue to serve as the Brand president of Bonobos under the new owners.

Hutchison said: “This is an exciting moment for Bonobos as we embark on the next phase of our growth. Born a digitally native vertical brand, we plan to build on our strength in eCommerce and customer loyalty, leverage EXPR’s expertise in omnichannel retailing and scale through WHP Global’s partnerships in licensing and distribution.”

The deal is subject to customary closing conditions and is expected to close in the second quarter of the company’s fiscal 2023.