The UK’s largest grocers must reduce costs while preserving service quality to manage escalating pressure on profit margins expected in 2025. While volumes will return to growth this year, marking the first increase in three years, this will coincide with rising inflation, presenting fresh challenges for the food and grocery sector. Grocers must exercise prudence in cost reduction to avoid compromising the intangible capabilities that bolster perceptions of value for money, namely customer service, store expansion renovations, and product range innovation.

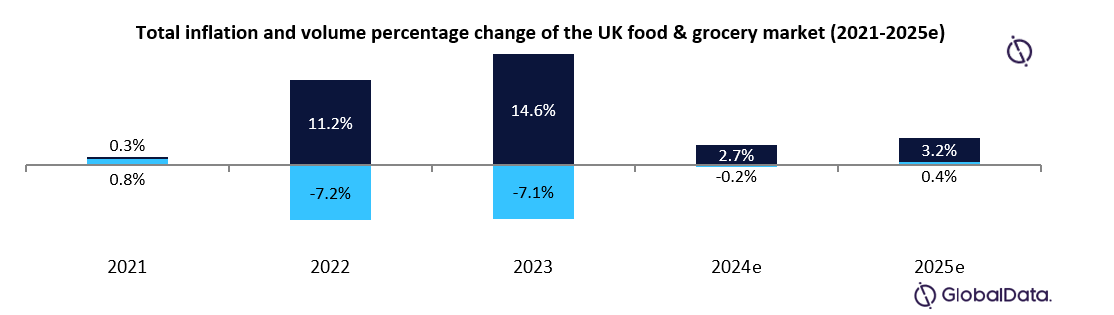

The trading environment for grocers in 2025 will be challenging. Leading data and analytics company GlobalData forecasts food inflation will increase between 3% and 5% in 2025, marking an acceleration from 2024. This growth is due to changes in National Insurance contributions and the implementation of a significant increase in minimum wages taking effect in April. These changes will hit the food and grocery sector harder than other retail sectors, owing to the considerable proportion of employees in lower wage brackets. Although these changes are poised to benefit consumers by improving living standards, they will inevitably contribute to inflation in the market. Consequently, grocers have been some of the most outspoken critics of the chancellor’s Budget amendments, highlighting the potentially detrimental effects on profits and margins. As of January 2025, Morrisons, Tesco and Sainsbury’s have announced job cuts, which they have claimed are due to the Budget and efforts to save costs. Such announcements from the UK’s leading grocers paint a bleak outlook for the rest of the market and signal further redundancies and profit warnings will arise in the year ahead.

Trading down and switching behaviour softened in the second half of 2024, as consumers adjusted to new price levels. Indeed, reactionary improvements by Tesco and Sainsbury’s during the height of the cost-of-living crisis established a more compelling price offer, which diminished the allure of discounters. Though food inflation is rising, volumes are forecast to return to growth of 0.4% in 2025, up 0.6ppts on 2024. As such, GlobalData expects fewer consumers will trade down to the discounters, opting instead to move between premium and cheaper own-brand ranges to manage costs. GlobalData expects key occasions such as Easter, Mother’s Day, and Christmas will continue fuelling demand for premium own-brand and private label ranges, and volumes will be highest during these periods. For the discounters, 2025 will bring strong headwinds after a period of uninhibited acceleration. Intense price matching directed at Aldi by the major grocers is finally showing signs of diminishing the discounter’s pace. For the four weeks to 24 December 2024, Aldi’s retail sales grew 3.4%, much of which was down to store openings, suggesting Aldi has lost momentum in switching gains and range appeal when consumers look for premium and high-quality items to celebrate Christmas. Though Lidl is in comparatively calmer waters, it will not be immune to squeezed margins and may struggle to retain its low-price mantra without the benefit of switching gains from the major grocers. As competition evens between discounters and major grocers, GlobalData expects a shift from intense price-matching messaging. This action is already evident in Asda’s announcement earlier in January to cull price matching in favour of focusing internally on ‘Rollback’ prices. Despite this, the discounters must retain price as a key message as consumers start to feel the pinch of food inflation rises.